When Disclosure Is Mandatory — Silence Isn’t an Option

I recently learned that a publicly traded company is required to provide advance notice (often ~40 days) of key shareholder events — including date, time, location, and agenda — pursuant to #SEC rules and applicable state laws. The purpose is simple: ensure shareholders receive timely, equal access to material information.

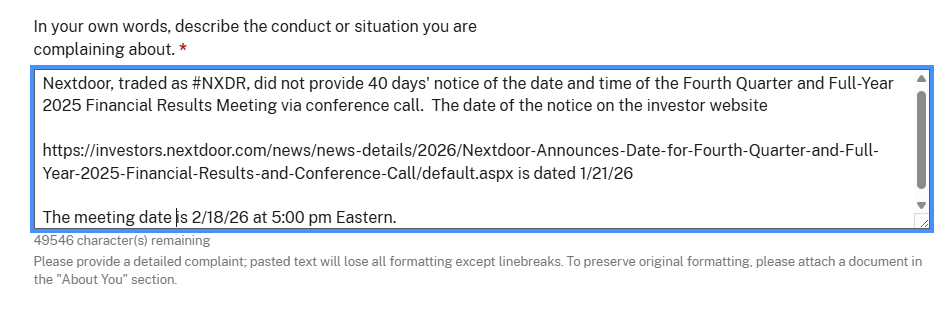

Nextdoor published its notice here, dated January 21, 2026:

https://lnkd.in/efQKWUag

Here’s the timeline as I experienced it:

- January 2, 2026: I submitted an email request to Investor Relations asking for shareholder-meeting details. No response followed.

- January 21, 2026: The company posted the notice publicly on its investor site.

- January 22, 2026: I filed an SEC complaint (Submission 17691-354-934-972) based on my understanding of disclosure obligations and the lack of response.

To be clear, I’m not asserting an outcome. Regulators determine facts and consequences. That said, public companies can face meaningful penalties if disclosure requirements are not met — figures often cited range widely (e.g., tens of thousands to hundreds of thousands of dollars, depending on the findings). They do not include reputational impact or remedial actions.

What’s frustrating is how easily this could have been avoided:

- Respond to a shareholder email.

- Keep engagement channels open.

- Don’t delete comments seeking clarity.

- Don’t block shareholders on LinkedIn.

- Communicate early and plainly.

Leadership sets the tone and accountability. Ultimately, the buck stops at the top, including #NiravTolia, for the culture and processes that allowed this breakdown.

When is it enough? When transparency becomes the default — not the exception.

Read more and subscribe to NielFlamm.com.

#NXDR #InvestorRelations #ShareholderRights #CorporateGovernance #SEC #Transparency #Leadership #Accountability #NiravTolia